Contenidos

Transatlantic trade and investment partnership

Dg trade

The leaked draft revealed that the treaty would not allow governments to pass laws for the regulation of strategic economic sectors such as banking, insurance, postal services or telecommunications.[7] In the event of any expropriation, court ruling or draft law or non-law, companies could sue states demanding compensation equivalent to the decrease in potential profits plus compensation and interest.[8] The treaty would allow the free movement of capital, establish quotas for the movement of workers, etc.[9][10] A previous treaty proposal was the Multilateral Agreement on Investment.

Together they account for 60% of world GDP, 33% of trade in goods and 42% of trade in services. The growth of the EU’s economic power has led to trade disputes between the two powers; although both are dependent on each other’s economic markets and disputes affect only 2% of trade. A free trade area between the two parties would potentially represent the largest free trade agreement in history, covering 46% of world GDP.[11] See below for details of trade flows.[12] The EU and the EU are also the largest trading partners in the world.

Tratado de libre comercio

Este documento presenta un análisis de la relación económica entre Estados Unidos y la Unión Europea a la luz de las negociaciones en curso para la Asociación Transatlántica de Comercio e Inversión (TTIP). Parte del supuesto de que Estados Unidos ha rediseñado su política comercial como consecuencia de la parálisis de la Ronda de Doha, con el fin de asumir un papel de liderazgo en el diseño del marco normativo que regirá el comercio internacional en el futuro. El TTIP forma parte de una estrategia estadounidense basada en la creación de acuerdos megarregionales sobre comercio e inversión. El documento evalúa los orígenes, las perspectivas y las consecuencias previsibles de este acuerdo actualmente en gestación.

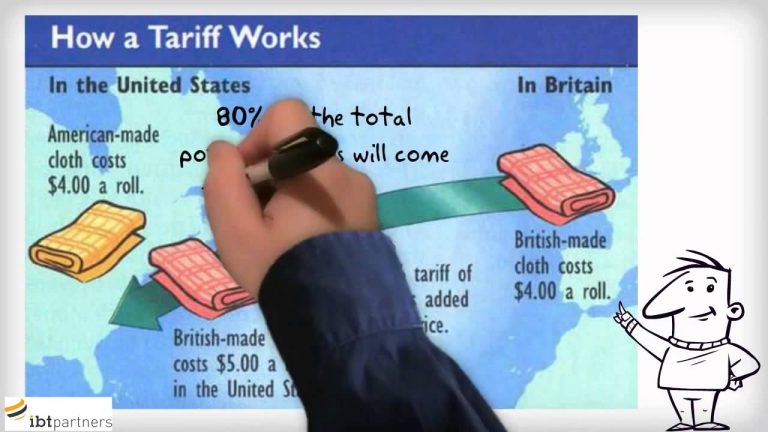

Las negociaciones del TTIP se proponen alcanzar un acuerdo de libre comercio “integral y de altos estándares”, teniendo como objetivo incrementar el acceso a los mercados transatlánticos mediante la disminución de barreras al comercio y la inversión, así como la armonización de medidas regulatorias.2 La reducción de aranceles no se considera un tema crítico de la negociación, pues se reconoce que se encuentran a niveles sustancialmente bajos. Antes bien, son las diferencias en los entramados regulatorios en ambos lados del Atlántico -que afectan especialmente el comercio de alto valor agregado- las que se considera imponen obstáculos muy significativos al comercio.

Free trade dominican republic

The leaked draft revealed that the treaty would not allow governments to pass laws for the regulation of strategic economic sectors such as banking, insurance, postal services or telecommunications.[7] In the event of any expropriation, judicial sentence or draft law or non-law, companies could sue states demanding compensation equivalent to the decrease in potential profits plus compensation and interest.[8] The treaty would allow the free movement of capital, establish quotas for the movement of workers, etc.[9][10] A previous treaty proposal was the Multilateral Agreement on Investment.

Together they account for 60% of world GDP, 33% of trade in goods and 42% of trade in services. The growth of the EU’s economic power has led to trade disputes between the two powers; although both are dependent on each other’s economic markets and disputes affect only 2% of trade. A free trade area between the two parties would potentially represent the largest free trade agreement in history, covering 46% of world GDP.[11] See below for details of trade flows.[12] The EU and the EU are also the largest trading partners in the world.

Transatlantic alliance

The leaked draft revealed that the treaty would not allow governments to pass laws for the regulation of strategic economic sectors such as banking, insurance, postal services or telecommunications.[7] In the event of any expropriation, court ruling or draft law or non-law, companies could sue states demanding compensation equivalent to the decrease in potential profits plus compensation and interest.[8] The treaty would allow the free movement of capital, establish quotas for the movement of workers, etc.[9][10] A previous treaty proposal was the Multilateral Agreement on Investment.

Together they account for 60% of world GDP, 33% of trade in goods and 42% of trade in services. The growth of the EU’s economic power has led to trade disputes between the two powers; although both are dependent on each other’s economic markets and disputes affect only 2% of trade. A free trade area between the two parties would potentially represent the largest free trade agreement in history, covering 46% of world GDP.[11] See below for details of trade flows.[12] The EU and the EU are also the largest trading partners in the world.